This article will be updated as new information is available.

| Stay Up to Date on the Space Economy Be among the first to know about the latest developments in the fast-evolving world of the Space Economy. Our weekly newsletter delivers summaries of all articles posted to NSE during the previous week. Receive the key highlights and updates in an easy-to-digest format directly in your inbox each Monday at 6 AM EST. Save time getting up to speed on the most important developments shaping the future of the space industry. |

Introduction

This article provides an analysis of the space tourism market from the context of customer demand, business sustainability, and market dynamics.

Highlights include:

- The market size for suborbital and orbital space tourism from 2001 to 2021 (20 years) was 22 customers collectively paying up to an estimated $846 million. 2021 accounted for 64% of the customers and 67% of the estimated sales.

- The forecast market growth between 2021 and 2022, is + 257% increase in private astronauts carried and + 98% increase in sales.

- There is significant current market demand for both suborbital and orbital space tourism.

- It is too early to determine if the space tourism market will transition to Early Majority customers or if it will end up as a boutique market for Early Adopters.

How it all began…

The true story of Albert the world’s first primate space tourist

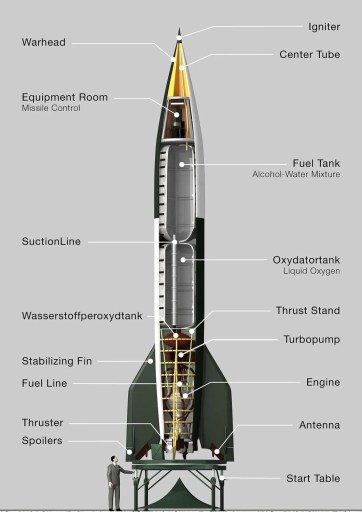

The story starts in World War II when Nazi Germany successfully used their V2 rockets to bombard England. The V2 was the world’s first long range ballistic missile and the first artificial object to fly into space (i.e. above 100 km).

As the war came to a close the United States made plans to take control of German technology. To that end, Operation Paperclip was established and a special military unit was created. The unit was tasked with rounding up German rocket scientists along with acquiring German V2 rockets, equipment, spare parts, and technical documentation. All of that material and the German scientists were shipped back to the United States, where the Americans began using the German rockets for research into new weapons and space exploration.

As American space research began in earnest, scientists quickly came to realize how much they had to learn about the challenges associated with space flight, in particular they were not sure if humans could survive in a zero gravity environment. They decided the best way to answer that question would be to launch an animal into space and recover it alive. Consequently the United States, as part of Project Hermes, decided to send four rhesus monkeys into space on modified V2 rockets to collect data. The monkeys were all to be launched from the White Sands Proving Grounds, a new military test range located in New Mexico that was established in 1946.

The monkeys were, unimaginatively, named Albert I, Albert II, Albert III and Albert IV. Their role in the experimental launches was to be a passenger. They did not know it at the time, but they were to be the world’s first primate space tourists (albeit involuntarily).

One by one, each Albert was scheduled, between 1948 and 1949, to be launched atop a V2 rocket which had been heavily modified for the experiments.

One by one, each Albert was instrumented, strapped securely into their seat, placed inside the small space at the top of the rocket (where the warhead would have been located during World War II)… at which point the technician probably smiled at Albert and said something like “Good luck little buddy!” before sealing Albert into the experimental vehicle.

One by one, each Albert was launched into space.…

Albert I’s attempt to reach space was not successful and unfortunately he died of suffocation due to the cramped capsule.

Albert II was successful in reaching over 100 km in height and became the first primate in space. Unfortunately he died on landing (impact) because the parachute failed.

Albert III’s attempt to reach space was not successful and unfortunately he died when the rocket exploded.

Albert IV was successful in reaching space but unfortunately he died on impact when the parachute failed (again).

Albert II and IV both experienced a few minutes of weightlessness, but because they had no windows to look out of, they were unable to experience a breathtaking view of the blackness of space, the curvature of the earth, or the beauty of earth visible from high altitude. Unfortunately both monkeys were certainly the first to confirm the Alien movie tagline “In space no one can hear you scream”.

Luckily for the scientists they were able to receive telemetry which confirmed both Albert II and IV had survived the period of weightlessness and were alive up to the point that they impacted the earth.

So ends the story of the world’s first primate space tourists – it is not a particularly happy story, but sometimes being the first comes at a high cost.

Subsequent to those flights, more monkeys and apes were sent into space to collect additional experimental data which paved the way for human space flight.

Scientists and engineers eventually solved the unfortunate parachute problem.

Today commercial space tourism flight operators do not use monkeys or apes. They have been supplanted by wealthy humans who eagerly pay for the privilege of being among the first to fly into space on an experimental vehicle (*). A fact for which today’s lower primates can thank their lucky stars having already “been there, done that” more than half a century before them.

* Note that only SpaceX and Soyuz are certified for human spaceflight.

Dennis Tito the world’s first higher primate space tourist

On April 28, 2001 Dennis Tito became the world’s first higher primate space tourist. Dennis Tito is a wealthy American entrepreneur who paid $20 million ($32 million in FY21) to travel to space. Tito flew to space on a Soyuz spacecraft and spent seven days in the International Space Station orbiting the earth.

“The pencils started floating in the air, and I could see the blackness of space and the curvature of the earth. I was euphoric. I mean, it was the greatest moment of my life, to achieve a life objective, and I knew then that nothing could ever beat this.” – Dennis Tito

Space tourism market overview

Space tourism is human spaceflight for recreational purposes.

Space is internationally recognized as being over 100 km in altitude. This 100 km threshold is known as the Karman line. In the US, the FAA recognizes altitudes above 80 km as space.

Space tourism is marketed under the following taglines: “Commercial Spaceflights to the ISS”, “Human Spaceflight“, “Become an Astronaut“, “Missions to Space“, “See The World As It Was Made To Be Seen” and “Fly to Space”.

Customers are generally referred to as “private astronauts”, “spaceflight participants”, “commercial astronauts” or “space tourists”.

The space tourism market has three market segments: suborbital, orbital, and lunar. This article focuses only on suborbital and orbital. Lunar space tourism remains largely aspirational. SpaceX has announced a lunar mission for 2023 based upon the still under development Starship. Roscosmos has stated they hope to offer a trip around the moon after 2030.

The space tourism market is primarily served by the following types of service providers: launch; spaceport; orbital destination; training; and private astronaut mission recruitment and management. The organizations currently providing space tourism services are shown in the following table.

Launch service providers transport customers to and from space. There are two types of launch service providers: suborbital spaceflight (Blue Origin, Virgin Galactic) and orbital spaceflight (SpaceX, Roscosmos). The difference between an orbital and a suborbital spaceflight is illustrated below.

A suborbital spaceflight will take the customer to altitudes of over 80 km and then back down to earth in a parabolic trajectory.

An orbital spaceflight will typically take the customer to 350 km or higher in altitude and will circle the earth until it is time to dock with a space station, or return for a landing. The International Space Station (ISS) is the usual destination for orbital space tourists.

A spaceport service provider is a ground-based facility for launching and receiving spacecraft.

Virgin Galactic uses Spaceport America in New Mexico. Blue Origin uses their own private space port in Texas. SpaceX uses Cape Canaveral in Florida for human spaceflight launches. Roscosmos uses Baikonur Cosmodrome in Kazakhstan for human spaceflight launches.

An orbital destination is a large artificial satellite orbiting the earth used for long-term human operations in space, e.g. ISS. There are currently two orbital destination service providers: NASA for the US ISS segments, and Roscosmos for the Russian ISS segments. Space tourists are carried to and from the US ISS segments by SpaceX, and by Roscosmos for the Russian ISS segments. The US will support up to four private astronauts at a time; Russia will support up to two. The following image is a picture of the ISS.

Additional orbital destination service providers are expected to be operational by 2030. The first commercial space station expected to be operational by 2030 is Axiom Station which is illustrated below.

Private astronaut mission recruitment and management service providers primarily do the following: recruit prospective customers, setup and manage contracts with launch service providers. However, they can also offer related services such as overall mission management. There are currently three companies operating in this service area:

- Space Adventures recruits prospective customers and handles mission contracting with launch service providers. They have relationships with launch service providers SpaceX, Roscosmos and Boeing.

- Axiom Space performs a range of services including: recruiting prospective customers; mission contracting with launch service providers; training; mission planning; hardware development (for any special experiments to be performed in space); medical support; crew provisions; hardware and safety certifications; on-orbit operations; and overall mission management. They have relationships with launch service providers SpaceX and Boeing.

- Glavkosmos recruits prospective customers and handles mission contracting with Roscosmos.

All launch service providers have their own private astronaut mission recruitment and management services. They also accept mission contracts from independent private astronaut mission recruitment and management service providers.

Training service providers offer training for spacecraft, mission profile, and ISS:

- Blue Origin and Virgin Galactic provide space vehicle orientation and training on safety procedures.

- SpaceX provides training for their Crew Dragon space capsule and mission profile.

- Roscosmos provides training for their Soyuz MS space capsule, mission profile, and Russian ISS segments.

- NASA provides training for the American ISS segments.

- NASTAR provides private astronaut training which allows them to experience the flight profile of different space vehicles. They offer programs for Orbital Spaceflight Participant Training and Suborbital Spaceflight Participant Training.

- NOLS provides wilderness survival training which will be useful in the event the spacecraft lands off course.

- ZeroG provides private astronaut training which allows them to experience weightlessness and learn how to maneuver.

Human spaceflight launch service providers technology overview

Virgin Galactic

The Virgin Galactic spaceflight system consists of a large aircraft called the Virgin Mothership (VMS) which carries the passenger carrying spacecraft called the Virgin Spaceship (VSS). Each VSS carries 2 crew and 6 passengers. Both the VMS and VSS are reusable. The VSS must have its rocket engine replaced after every flight.

The flight profile for Virgin Galactic is illustrated below.

Blue Origin

The Blue Origin spaceflight system consists of a Crew Capsule and a Propulsion Module (also known as a Booster). The Crew Capsule can carry 6 passengers. Both the Crew Capsule and the Propulsion Module are reusable.

The flight profile of the Blue Origin spaceflight system is illustrated below.

SpaceX

The SpaceX spaceflight system consists of a Crew Dragon capsule and a Falcon 9 booster. The capsule and the first stage of the booster are both reusable.

The flight profile for the SpaceX spaceflight system is illustrated below.

Roscosmos

The Roscosmos Soyuz spaceflight system consists of a Soyuz MS crew capsule and Soyuz-2.1a booster. The crew capsule can carry 2 passengers and 1 crew. The spaceflight system is not reusable and both components must be built for each launch.

Boeing

The Boeing spaceflight system consists of a CST – 100 Starliner crew capsule and an Atlas V booster. The Boeing CST – 100 Starliner can carry up to 7 passengers. The crew capsule is reusable, however the booster is expendable.

The flight profile of the Boeing Starliner is illustrated below.

Customer demand and market size estimates

The following subsections will examine customer demand from the context of:

- Product offering,

- Customer motivations,

- Customer experience,

- Customer adoption challenges,

- Total addressable market,

- Market size from 2001 to 2021,

- Current market demand as of the end of 2021,

- Market supply 2023,

- Market size 2022, and

- Market growth 2021 to 2022.

Product offering

Space tourism businesses are currently offering a high end luxury experience (or an extreme-adventure experience depending on your point of view) that includes:

- Flight in a space vehicle to suborbital or orbital space

- A view of the earth from a high altitude that will allow customers to see the curvature of the earth and the blackness of space.

- A period of zero gravity inside a small enclosed space shared with other customers.

- The opportunity to refer to themself as an astronaut, e.g. social differentiation, status symbol.

- Ground-based activities including: pre-flight training, exclusive networking events, VIP access to the launch for their families, postflight celebrations and presentation of astronaut wings, media events, etc.

The ticket price for a flight into space is costly, starting at $450,000 for a suborbital flight on Virgin Galactic and rising to over $50 million for an orbital flight on SpaceX or Roscosmos.

Passenger experience

The article “An intro to space tourism preflight training in under five minutes!” provides a detailed look at the pre-flight training experience and the associated time demands on customers.

The article “The essential guide to what a space tourist can do in space” provides a comprehensive review of the types of activities available for customers to do.

Customer motivations

So what would motivate someone to want to travel into space? Some insights into customer motivations are available from a 2018 study performed by the PEW Research Center, which identified the top three motivations for a customer to purchase a flight into space as:

- To experience something unique ( e.g. pioneering, exclusive, one of a kind)

- To see the view of Earth from space

- To learn more about the world

The PEW study also found that only 42% of Americans would be definitely or probably interested in going into space.

Customer adoption challenges

For someone who is financially qualified and is motivated to fly into space, what could prevent them from doing so? Well, quite a lot. As it turns out, customer adoption challenges currently include:

- Risk

- Personal time commitment

- No orbital destination available

- Experience is unappealing relative to preconceived expectations

- Legally restricted

- Health disqualification

- Negative social differentiation

- Public perception

- Not considered pioneering or unique

- Media coverage makes all customers public figures

- Wait for better products

- Wait for opinion leaders

- Language

- Travel concerns

Risk

Space tourism marketing presents spaceflight as glamorous, pioneering and exciting. However what the marketing doesn’t mention is the risk associated with a spaceflight. Once customers are made aware of the risks, they may not be willing to accept the risk of death or serious injury.

In the commercial airline space the FAA provides regulation and oversight of the public’s safety including the aircraft and passengers. However, for space tourism flights the FAA does not regulate or provide oversight for the spacecraft or passenger safety. Their responsibility is to protect uninvolved parties on the ground from being injured or killed. Instead of regulation and oversight of space tourism passenger safety, the FAA relies upon informed consent.

Informed consent requires that all space tourism businesses make customers explicitly aware that the FAA has not certified the vehicle as being safe for human flights. The customers must also be made aware of the history of human spaceflight accidents, the safety history of the vehicle they will be flying in, and all associated known and potential risks. Customers must acknowledge in writing that they fly into space entirely at their own risk.

The article “SPACE TOURISM – Passengers fly at their own risk” provides more details on informed consent.

What is the risk of death? The following fatality rate information helps put the risk in context.

The in-flight astronaut fatality rate as of March 2021 was 1 death in 31 boardings or 3.2%.

For comparison, the in-flight passenger fatality rate for commercial airlines between 2008 and 2017 was 1 death in 7.9 million boardings or 0.000013%.

It is particularly worth noting that between 2010 and 2018, the fatality rate for Mount Everest climbers was 1 death in 111 summit attempts or 0.9%.

Space tourism customers will need to have a higher risk tolerance than a Mount Everest climber.

Personal time commitment

Moving on from risk, customers must commit to several days of personal time (e.g. travel, pre-flight training, ground based events, quarantine) in return for 10 to 90 minutes of total flight time for suborbital flights. For orbital flights, customers may need to commit several weeks to months of personal time in return for 3 days to weeks of total flight time. The time demands may be a barrier for customers based on their available leisure time and scheduling flexibility. For example, Axiom Space’s Ax-1 mission has a training schedule that runs from May 2021 to February 2022.

No orbital destination available

Currently the only orbital destination that is open to space tourists is the ISS. NASA and Roscosmos have a limited number of private astronaut mission slots available per year. The alternative is to orbit the Earth in a SpaceX Crew Dragon with a special observation bubble attached to the nose of the space capsule as shown below (Source: SpaceX).

For orbital space tourism customers this may be problematic. They may not want to invest the time and money for an orbit inside a space capsule. Consequently they may decide to wait until such time as an orbital destination slot is available.

Experience is unappealing relative to preconceived expectations

Customers may find that the overall experience is unappealing relative to preconceived expectations versus the reality of such things as: scary takeoff and landing, claustrophobic and cramped quarters, lack of privacy, primitive toilet facilities on orbital flight vehicles, orbital space destination characteristics (i.e. orbiting while living inside a space capsule versus orbiting while living inside a space station), mundane activities available for them to do, things not always going as planned, and space motion sickness.

Things don’t always go as planned – during the first orbital space tourism flight by SpaceX, the toilet in the Crew Dragon malfunctioned; during the same flight, one of the four passengers suffered from space motion sickness for two days out of the three day flight. During Richard Branson’s Virgin Galactic flight, the vehicle went off course on the descent flight path, potentially endangering commercial airlines and Virgin Galactic passengers. Launches have been delayed due to weather and equipment readiness; launch delays of days or weeks are a fact of life.

The incidence of space motion sickness among astronauts is high, with 60 to 80% of space travelers experiencing space motion sickness caused by zero gravity. Space motion sickness has many of the same symptoms as other forms of motion sickness, e.g. cold sweating, nausea, loss of appetite, fatigue, vomiting. Space motion sickness will spoil the experience for the afflicted customer as well as for that of the other customers. After all, who wants to be dodging floating vomit in zero gravity, or being stuck in a confined space engulfed in the smell of vomit, or spend most of their time in orbit being sick and unable to appreciate the experience.

Legally prohibited

Customers who are key employees of a business may be restricted by their employment contract from participating in risky extracurricular activities such as engaging in spaceflight. The death or injury of a business’ key employee can have a major impact on the ongoing operation of the business, and if it’s a public company can also have a dramatic impact on the stock price.

Health disqualification

Customers can be disqualified (by the space tourism business or NASA) from flying due to one or more issues related to their: security risk; medical fitness (e.g. weight, mobility, vision, height, hearing, mental health (e.g. anxiety, bipolar disorder, depression), medical condition (e.g. heart disease, pregnancy, diabetes); ability to tolerate acceleration, air pressure changes and microgravity; and ability to perform safety procedures. For example, Daisuke Enomoto was scheduled to fly in 2006 but was disqualified by Roscosmos from flying due to a medical condition (kidney stones).

The FAA has not established any medical certification requirements for suborbital or orbital space tourism customers. Customers and space tourism businesses are expected to make their own judgment calls on medical fitness. The only exceptions are for trips to the ISS. NASA has medical requirements that all private astronauts and commercial crew must meet in order to be allowed to visit the ISS.

Physical fitness screening by SpaceX and Roscosmos is comprehensive for orbital flight because the experience is demanding. Moreover, since flights can last for a few days to a few weeks it is important to avoid sending anyone into orbit who might end up with a medical emergency due to a pre-existing health issue.

The physical fitness of potential viable customers may reduce the serviceable addressable market size for the orbital space tourism market segment. The average age of very high net worth individuals is 60.3 years. Ultra high net worth individuals are even older, with an average age of 64. Common conditions in older age which could disqualify customers include hearing loss, cataracts and refractive errors affecting eyesight acuity, heart disease, hypertension, osteoarthritis, depression, obesity, and diabetes.

Suborbital flight is short duration and not as physically demanding as orbital flight, so the physical fitness screening is much more relaxed. For example the medical clearance screening requirements for a Blue Origin suborbital flight include: able to climb up the launch tower in less than 90 seconds (approximately seven flights of stairs); able to walk quickly over uneven surfaces; able to fasten and unfasten their seatbelts in less than 15 seconds; hear and understand instructions in English and reliably follow them; able to sit in a seat for 40 to 90 minutes without getting up or having to go to the bathroom; able to sit in a confined capsule for 40 to 90 minutes with up to five other people; be between 5’0” 110 pounds and 6’4” 223 pounds; and able to tolerate up to 5.5 times of their normal body weight pushing them into their seat for a few seconds.

Negative social differentiation

Customers may find that the desired positive social differentiation they hope to achieve might in fact be a negative social differentiation. Customers referring to themselves as an astronaut, payload specialist, medical officer, mission commander, pilot, pioneer, explorer, etc – may be subject to ridicule.

Public perception

Customers may not like the public perception of the product or space tourism business – as that perception might reflect upon them and companies that they are associated with. For example, customers may be stigmatized by public opinion which increasingly views space tourism as a frivolous activity for rich people who are indifferent to the many social issues here on earth. Space tourism is also increasingly viewed as being harmful for the environment.

Not considered pioneering or unique

One of the top three motivations for a customer to want to fly into space is to do something that very few people have done before them. At some point space tourism will no longer be considered pioneering or unique, and will become a barrier to adoption for some customers.

When will space tourism no longer be considered pioneering? Mount Everest can be used as an example.

Between 1953 and the end of 1992, 427 people had successfully summited Mount Everest. However things changed in 1993 – summiting Mount Everest stopped being pioneering when commercial guiding businesses came into being and made it possible for anybody with enough money to summit Mount Everest. Today it is possible to summit Mount Everest as part of a commercial expedition for an average cost of $45,000. As of 2020, 5,720 people have summited Mount Everest, including a double leg amputee, a blind woman, and a man with one arm.

7.5% of all the people who summited Mount Everest did so in the 40 years before commercialization. However, 92.5% of all the people who summited Mount Everest did so in the 28 years after commercial guiding businesses came into being.

It could be argued that space tourism stopped being pioneering after Dennis Tito flew to the ISS in 2001 as the first commercial space tourist.

It is also worth noting that the introduction of commercial guiding made climbing Mount Everest more accessible and consequently significantly increased demand to climb Mount Everest. The sustained demand created a multi million dollar market. As new commercial guiding businesses entered the growing market, the cost per climber continued to decline.

Media coverage makes all customers public figures

The corporate marketing of space tourism launches and associated media coverage makes all customers public figures overnight. Customer such as high net worth individuals may be adverse to such publicity.

Wait for better products

Customers may want to wait in expectation of better products.

Wait for opinion leaders

Customers may choose to wait for opinion leaders to evaluate the products and have the benefit of their insights and recommendations.

Language will be an issue

Language will be an issue for some customers whose native language is not English or Russian. Currently all space tourism operations are English-centric or Russian-centric.

Travel concerns

Customers may not want to travel to Russia or Kazakhstan which would exclude Roscosmos from consideration. Customers may also be stopped from traveling due to government travel advisories. For example there is currently a no travel advisory for Kazakhstan.

Customers may not want to travel to the US which would exclude Virgin Galactic, Blue Origin, and SpaceX.

Customer adoption challenges constrain the size of the serviceable addressable market and associated customer demand.

Total Addressable Market (TAM) size

So how big is the space tourism market size?

The ticket price is the fundamental customer adoption barrier and can be used to define market size.

For an orbital customer, the Space Tourism Market Study identified that the ticket price should be no more than 10% of the individual’s net worth for that individual to be considered a viable customer. For a suborbital customer, the ticket price should be no more than 1.5% the individual’s net worth.

The following table provides a breakdown of global high net worth individuals.

Looking deeper, the following table shows the wealth tiers within the ultra high net worth individual wealth band.

Using the above data tables and the 1.5% and 10% rule described earlier, we can identify the market sizes for the suborbital and orbital space tourism market segments.

Suborbital space tourism has tickets starting at $450,000. This means that the potential viable customers would be individuals worth $30 million or more, i.e. the ultra high net worth individual wealth band.

Orbital space tourism has tickets starting at $50 million. This means that the potential viable customers would be individuals worth $500 million or more, i.e. the top two wealth tiers of the ultra high net worth individual wealth band (2.6399% of 200,900).

The following table captures the resulting space tourism estimated market size.

All the potentially viable customers in the above table have the financial means to fly into space. The actual number of customers in a space tourism business’ serviceable addressable market depends upon the number of those individuals who are motivated to fly into space and who are not excluded by customer adoption challenges.

Market size from 2001 to 2021

What was the space tourism market size from 2001 to the end of December 2021? To answer this question, we can take a look at results from the space launch service providers over the last 20 years.

What’s happened until now…

Virgin galactic

Virgin Galactic has not flown any paying customers as of December 2021. Virgin Galactic was open for ticket sales between 2004 and 2014. During that period of time, they secured approximately 600 customers from 58 countries. Those customers collectively paid over $80 million in refundable deposits for future flights priced at $250,000. Virgin Galactic also have over 900 customers who have expressed an interest in future flights and who have collectively paid approximately $900,000 in refundable deposits in order to give them priority for a future booking. After Richard Branson’s flight, 60,000 people signed up on their website to request information on flying with Virgin Galactic.

In 2021, Virgin Galactic made changes to their pricing, flights now start at $450,000 per passenger. Virgin Galactic also restarted ticket sales in 2021 and secured an additional 100 customers for future flights at the new ticket price. Ticket prices are within reach of the very high net worth and ultra high net worth individuals.

Virgin Galactic is expected to begin commercial operations in 4Q 2022.

Virgin Galactic currently operates out of Spaceport America in New Mexico, with intentions to establish spaceports in Italy and Dubai.

Other notable Virgin Galactic customer related events include: Several celebrities have signed up for tickets, including: Leonard DiCaprio, Justin Bieber, Rihanna, Katy Perry, Tom Hanks, and Angelina Jolie. Ashton Kutcher, an actor and technology investor, returned his ticket to Virgin Galactic due to concerns over risk. Lady Gaga has been invited to perform on a future flight. Also, in 2011, William Shatner (actor, “Captain Kirk”) was offered the opportunity to fly to space by Richard Branson, but he declined. Shatner commented to reporters “He wanted me to go up and pay for it and I said: ‘Hey, you pay me and I’ll go up. I’ll risk my life for a large sum of money.’ But he didn’t take me up on my offer.”

Blue origin

Blue Origin has flown 8 paying customers as of December 2021, and has another 6 paying customers committed to fly in 2022, for a total estimated $392 million. In 2021, Blue Origin ran an auction for a seat on the first commercial launch of New Shepard. The auction winner ended up paying $28 million, which puts Blue Origin tickets within the reach of ultra high net worth individuals. In 2018 it leaked out that Blue Origin was planning to offer tickets for between $200,000 and $300,000 which would put tickets within reach of the very high net worth individuals and ultra high net worth individuals.

It is worth noting that the Blue Origin seat auction had 7,600 registered bidders from 159 different countries, which shows significant customer interest.

Blue Origin launches spaceflights out of a spaceport in Texas, with intentions to set up a spaceport in Dubai.

Other notable Blue Origin customer related events include: Tom Hanks (actor) recently disclosed that he was offered a flight by Jeff Bezos, but declined because of the high price of $28 million. William Shatner (actor) and Michael Strahan (TV personality) flew to space with Blue Origin in 2021 as guests of Jeff Bezos. In exchange for the free flights, Blue Origin received global media coverage and enthusiastic endorsements from the celebrities. And last but not least, Amazon Prime Video produced a documentary covering William Shatner’s spaceflight and it is currently streaming.

Roscosmos

Roscosmos has flown 10 paying customers (including 1 American who flew twice) as of December 2021, for total estimated sales of $600 million. Flights are estimated to have cost between $50 and $60 million per passenger, which puts Roscosmos tickets within the reach of ultra high net worth individuals ($500+ million).

Roscosmos launches all human spaceflights out of Baikonur Cosmodrome in Kazakhstan.

Other notable Roscosmos customer related events include: Roscosmos flew Dennis Tito to the ISS in 2001, making him the first space tourist. Daisuke Enomoto was scheduled to fly in 2006 but was disqualified from flying due to a medical condition. Sarah Brightman was scheduled to fly in 2014 but canceled during training due to personal reasons. In 2021 Roscosmos flew a Russian film crew to ISS for production of a film. As an interesting sidenote, Guy Laliberte (the first Canadian space tourist) tried unsuccessfully to claim the $42 million ($53 million in 2021) cost of his 2009 trip with Roscosmos as a Cirque du Soleil business expense.

SpaceX

SpaceX has flown 4 paying customers and currently has another 4 paying customers that will launch in February 2022 – for total estimated sales of $440 million. Flights cost $55 million per passenger, which puts SpaceX tickets within the reach of ultra high net worth individuals ($500+ million).

SpaceX launches all human spaceflights out of Cape Canaveral and may be constrained by availability of launch slots.

Other notable SpaceX customer related events include: In 2020 NASA announced they were working with SpaceX and Tom Cruise to produce a movie on the ISS; no timeline was released. A Japanese billionaire has committed to paying for an around the moon flight with SpaceX. The moon flight is scheduled for 2023 and will include up to 12 passengers and crew; the flight cost was not disclosed. Space Adventures recently had to cancel a planned orbital trip using SpaceX when they were unable to find customers for that reservation. And last but not least, a Netflix miniseries covering the Inspiration4 mission was produced and is streaming now.

Adding it all up

The market size for suborbital and orbital space tourism from 2001 to 2021 (20 years) was 22 customers collectively paying up to an estimated $846 million. 2021 accounted for 64% of the customers and 67% of the estimated sales.

The following table summarizes the space tourism market size for 2001 to 2021.

The following table summarizes the space tourism market size for 2021.

Those that tried and failed

It is also worth noting some of the service providers who tried and failed in the last 20 years while attempting to enter the space tourism market: Mircorp, Bristol Spaceplanes; RocketShip Tours; PlanetSpace; Benson Space Company; Armadillo Aerospace; XCOR Aerospace; and EADS Astrium. The reasons three service providers failed:

- Armadillo Aerospace was founded by and largely self funded by John Carmack (ID software). He shut down the company because he was not happy with the speed of development, design decisions, and how the corporate culture had evolved since the company‘s founding.

- XCOR Aerospace filed for bankruptcy when it was unable to secure the necessary investment to continue development of their suborbital spacecraft.

- EADS Astrium was unable to secure the necessary investment to continue development of their suborbital spacecraft.

Current customer demand

So what does the current customer demand look like? Currently there are two datapoints for suborbital flights and one datapoint for orbital flights that can be used as firsthand indicators of current customer demand.

Blue Origin provides the most recent indicator of potential demand for suborbital flight. When they ran their auction in 2021, all auction bidders were required to register. Any auction bidder who wanted to bid more than $50,000 had to go through a qualification process that also required a $10,000 deposit.

Blue Origin has $200,000 as their low end ticket price and the auction result established $28 million as their high end price. The registered auction bidders represent a sales funnel of approximately 7,600 prequalified customers, delivering potential sales of up to $1.52 billion and as high as $212.8 billion. It is unlikely that a significant number of individuals will pay $28 million for a seat. The actual price will be somewhere in between the low and the high end of the ticket prices. For the purpose of estimation, a calculation for the low end and the high end ticket prices will be done.

Virgin Galactic has approximately 1,600 prequalified customers who have made deposits for a flight. These customers represent potential sales of up to $600 million.

In 2019, NASA opened up the ISS for private astronaut missions. NASA plans to allow up to 2 missions per year, with a maximum of 4 private astronauts per mission.

The ISS was originally scheduled to be retired on September 30, 2024. However, new US legislation is progressing forward which will specify that ISS be sustained by NASA at maximum utilization through at least September 30, 2030. It is not certain if ISS will be maintained in an operational state beyond that date; if not that might also impact the number of private astronaut mission slots available.

NASA’s first 2 private astronaut missions to ISS will occur in 2022. With 2 missions per year, and 2030 being the last operational year for ISS, there are 16 private astronaut mission slots available. Note that 16 mission slots is the maximum number of slots, the actual number may end up being less depending upon NASA priorities.

As of August 2021, NASA had received 7 proposals. The 7 proposals represent a potential demand of 28 customers delivering sales of up to $1.54 billion between 2022 and 2030.

The current customer demand will consume 44% of NASA private astronaut mission slots.

Based on the volume of interest in private astronaut missions to the ISS for tourism and entertainment NASA believes that space tourism will be the chief revenue generator for low earth orbit commercialization.

Roscosmos has not released any information on demand for private astronaut missions to the Russian ISS segments.

Based on the above datapoints, the estimated current market demand is summarized in the following table.

Note that it is not possible to determine if these indicators of current customer demand represent an annual demand or if they represent total demand. It is also uncertain if the numbers exclusively represent Innovators and Early Adopters, or if they are characteristic of broader market adoption.

Forward-looking ten-year demand forecasts could be prepared based upon the diffusion of innovations theory (e.g. using Bass Diffusion Model), but the space tourism market is too uncertain for such a forecast to be meaningful (except perhaps for raising investment). Moreover, relative to the orbital space tourism market segment, there is no need for a service provider to try and “crystal ball” a forecast. With 7,800 potential viable customers, prospective customers can be engaged directly to determine interest.

A big uncertainty at this point is if space tourism will “cross the chasm” between Early Adopters and Early Majority. What attracts Early Adopters to a product or service can be different than what attracts Early Majority customers.

Estimated market size 2022

While a 10 year forecast might not be of particular use, it is possible to estimate the market size in 2022. This is done using publicly available information and analysis of launch service providers ability to service customer demand (see the next section).

Axiom Space and NASA have announced two space missions to the ISS in 2022, Ax-1 and Ax-2. SpaceX is providing transportation to and from the ISS.

Virgin Galactic is planning to start commercial operations in 4Q 2022. It is expected they will launch at least one space tourism flight in each of October, November, and December.

Blue Origin is expected to launch at least four commercial flights in 2022. Based upon the auction bidding it is assumed that Blue Origin will be able to maintain a high price point in 2022. Calculations are made for both low and high end price points.

Roscosmos is not expected to launch any space tourism missions in 2022. Missions to orbit are usually announced in the preceding year.

Market growth between 2021 and 2022

The maximum estimated market growth between 2021 and 2022, is + 257% increase in private astronauts carried and + 98% increase in sales. The actual market growth will depend upon Blue Origin ticket prices which will be somewhere between $28 million and $200,000 per seat. It is unlikely that Blue Origin will be selling seats for as low as $200,000 in 2022.

Business sustainability

Space tourism businesses, like any start-up, are sensitive to delays in sales growth. Delays impact their ability to achieve a sustainable cash flow and necessitates ongoing fundraising and investment. Moreover, delays in establishing market sales leadership or delays in servicing customer demand in a timely manner leaves the door open for competitors to enter and service the demand.

Sales growth for space tourism will not be urgent concerns for some businesses such as SpaceX, where space tourism is currently a side business. SpaceX is generating strong sales from their core business which is commercial space operations (i.e. launching satellites, delivering and returning cargo and astronauts to ISS). For other businesses where space tourism is their primary source of sales, sales growth will be much more problematic.

It is not clear if Blue Origin will feel urgent concerns since Jeff Bezos is selling $1 billion of Amazon shares every year to fund Blue Origin. However, Jeff Bezos has said that his goal is to make Blue Origin profitable.

Virgin Galactic is feeling some urgency. On January 13, 2022 they announced intentions to raise $425 million in debt. When could Virgin Galactic run out of money? A recently published article examined that question:

- As of September 2021, Virgin Galactic had sufficient cash to support three years of operations, i.e. to 2024.

- Analysts believe that Virgin Galactic will break even in four years of operations, i.e. 2025.

- Virgin Galactic will need to raise additional capital before breaking even.

- Virgin Galactic’s future success in raising capital will be heavily dependent upon their sales outlook and their market capitalization. It will certainly result in shareholders being further diluted in the future.

Sales growth is dependent upon: increasing customer demand, ability to service customer demand, and competition. These three critical dependencies will be explored below, along with a forecast of potential market supply by 2023.

Increasing customer demand

Customer demand can be increased through skillful sales and marketing.

Customer demand can also be increased by expanding the serviceable addressable market. This can be done by addressing the previously described adoption challenges either by mitigating or by eliminating. Some areas of opportunity and current best practices follow.

Ticket price

Ticket prices are the fundamental customer adoption challenge.

Ticket prices can be reduced by: reducing margin; reducing costs; and adjusting the product offer so that the cost to deliver is lower.

Roscosmos recently started directly selling orbital space flights. This could give them some pricing flexibility. Up until the end of 2021 all of Roscosmos space tourist customers were acquired through Space Adventures. Space Adventures took a commission estimated to be 10%.

Blue Origin’s original pricing plans were leaked back in 2018; ticket prices were to start at $200,000 to $300,000. However, Blue Origin has never publicly announced their ticket pricing. Furthermore, they have been very careful to avoid talking about pricing.

At this point, it looks like Blue Origin has adopted a price skimming strategy when it comes to setting their ticket price for a suborbital flight. The objective of this price skimming strategy is to exploit the low price sensitivity of Innovators.

Blue Origin used their seat auction as a means to establish the initial pricing and sales funnel. They now have: a prequalified list of high net worth individuals; insight into the starting point ticket price; and insight into what the ticket price sensitivity is.

Blue Origin can be expected to work their way through the 7,800 auction bidders, offering them a “next in line” ticket at the highest price they think the market will bear. Only lowering the price once the demand for tickets at that price starts to decline. Then continuing the cycle again.

Risk

This customer adoption challenge can be mitigated through marketing and raising awareness of the safety features and track record of the experience being offered.

Roscosmos and Blue Origin are both moving in that direction with their marketing messaging as evidenced in the following pictures.

Health disqualification

This adoption challenge primarily affects orbital space tourism, particularly travel to the ISS.

It is not possible to eliminate this adoption challenge. However it is possible to mitigate by making customers aware of what types of health conditions can be accommodated and controlled. Making customers aware can ensure they do not exclude themselves from pursuing a suborbital or orbital experience because they feel that they are too old.

Blue Origin has taken steps to dramatically highlight that suborbital flight on New Shepard is for the very young and the very old. As of December 2021, they had launched into space the youngest man (18 years old), the oldest woman (82 years old), and the oldest man (90 years old). All three gave enthusiastic endorsements.

Not considered pioneering or unique

The definition of “pioneering” and “unique” is malleable. In the absence of the businesses defining this term it will be left up to the personal opinion and imagination of the customer.

Blue Origin has been the first to recognize the importance of ensuring suborbital flight is viewed as “pioneering” and “unique” for as long as possible. In this regard they have introduced the concept of a customer “Being one of the first 1,000 people to visit space”.

Media coverage makes all customers public figures

This adoption challenge can be eliminated by offering “stealth” flights. No press releases and no media present. It’s up to the customer to say what they want to say and when they want to say it, if ever.

Wait for better products

This adoption challenge can be mitigated by using the scarcity principal of persuasion. The scarcity principle of persuasion means the rarer or more difficult it is to obtain a product, the more valuable it becomes. Because we think the product will soon be unavailable to us, we’re more likely to buy it than if there were no impression of scarcity.

In the case of space tourism, highlighting the “once in a lifetime”, “historical legacy” aspects of the experience is tailor made to being exploited using the scarcity principle of persuasion. Examples of how this could be applied in the context of the customer securing their place in history:

- Be one of the first 1000 people to visit space

- Be one of the last few people to visit the ISS before it is decommissioned

- Be the first person from [country] to visit the ISS

- Be one of the first 10 people to visit the world’s first commercial space station

- Be the first person from [country] to visit space

A generalized sales tool could be created to generate a customized list appropriate to the prospective customer, along lines of:

- Be the first [person | woman | man | private astronaut | LGBTQ+ | one armed man | etc.] of [country] to [visit space | visit the ISS | visit the world’s first commercial space station | walk in space | etc.]

As of December 8, 2021, 251 people from 19 different countries have visited the ISS.

Wait for opinion leaders

Endorsements from people who are well-known and respected can go a long way towards overcoming this adoption challenge. However endorsements do not come for free. It takes planning and focused effort to secure them and ensure the right endorsements are being selected to match the market demographic.

Blue Origin has been aggressively working to address this adoption challenge. They have gone after big names and put them front and center for each launch. So far they have launched William Shatner and Michael Strahan into space in order to secure their enthusiastic endorsement and global media coverage.

SpaceX and Blue Origin have both produced documentaries following customers through the experience from beginning to landing. The documentaries are streaming on Netflix and Prime Video.

Virgin Galactic has announced plans to include a social media influencer on one of their future commercial flights.

Language will be an issue

It is impossible to completely eliminate this adoption challenge. However it is possible to strategically select which languages to integrate into the product offer and operational support infrastructure. The selection of which language to add and when, being driven by how much each language contributes to expanding the serviceable addressable market for the business. After the US, the next three countries with large high net worth populations are Japan, Germany and China.

Travel concerns

This customer adoption challenge can be mitigated by operating out of spaceports outside of the US, Russian Federation and Kazakhstan.

Virgin Galactic has expressed it’s intentions to establish spaceport operations in Italy and Dubai.

Blue Origin is working with the UAE government to establish a spaceport in Dubai.

Roscosmos has the potential ability to launch from Europe’s French Guiana spaceport. However, only cargo missions have been launched from that spaceport so far and then there is the question of where would the capsule land.

Ability to service customer demand

Flight capacity constrains a space tourism business’ ability to service customer demand. All space tourism companies are fundamentally constrained by the number of space vehicles available, the number of customers each vehicle can carry per flight, and the lifecycle of each space vehicle.

Number of operational spaceflight systems

Virgin Galactic has 1 operational VMS and 1 VSS to service customer demand. They also have a second VSS that’s currently being readied for flight, but currently not available. They have announced intentions to build their fleet to a total of 2 VMSs and 5 VSSs. This is also the size of the hanger that they have available at Spaceport America. No timelines have been disclosed.

Blue Origin currently has one spaceflight system available to service customers. They have announced plans to build additional Crew Capsules and Propulsion Modules. No numbers or timelines have been disclosed.

SpaceX currently has 3 Crew Dragon capsules available, and have announced that they are building 1 additional. The fourth Crew Dragon is expected to be ready for launch in April 2022. As of October 2021, SpaceX had eight Falcon 9 boosters operational.

Lifecycle of each vehicle

The lifecycle of space vehicles will have a significant impact on the ability of space tourism businesses to service customer demand and grow sales. The lifecycle of a space vehicle includes: how much time must be taken between flights for mission planning, safety checks and refurbishment; how many total flights can a vehicle be used before having to be replaced; and how long does it take to build and bring into service new vehicles.

SpaceX has stated that they expect to reuse a Falcon 9 booster over 100 times before it needs to be replaced. As of May 2021, a Falcon 9 booster has been reused 10 times. The fastest turnaround time on a Falcon 9 booster has been 27 days. As of October 2021, SpaceX had eight Falcon 9 boosters operational allowing for up to 104 launches per year.

Crew Dragon capsules can be reused up to 5 times. There is no information available for Crew Dragon turnaround time. Pending information to the contrary it is assumed that a Crew Dragon can be reused five times in a year.

For every Crew Dragon and 39% of a Falcon 9 booster’s annual launch capacity dedicated to space tourism, SpaceX would be able to launch 5 flights a year. This would deliver an estimated annual capacity of 35 passengers and estimated yearly sales of up to $1.925 billion.

For 2023, it is assumed that there will be the equivalent of 1 Crew Dragon available for space tourism flights. It is assumed that each Crew Dragon will only carry 4 passengers per flight.

Roscosmos has stated that their goal is to launch up to 4 space tourism flights per year. This would give an estimated annual capacity of 8 passengers and estimated yearly sales of up to $480 million. A NASA report stated that construction of a Soyuz spaceflight system typically takes three years.

Space Adventures is offering 2 seats flying on Roscosmos in 2023. Roscosmos has announced they are reserving four seats for space tourists for launch in 2024.

For 2023, it is assumed that Roscosmos will have 1 vehicle available for space tourism flights.

Virgin Galactic has said the VSS is built to last for 10 years and can be flown up to 50 times a year. Each VSS needs to have its rocket engine replaced after every flight which costs $250K to $275K. Each VSS costs between $30 and $35 million to build. No information has been disclosed on the lifecycle of the VMS.

Virgin Galactic has stated that their goal is to launch 400 flights a year per spaceport. This would give each spaceport an annual capacity of 2,400 passengers delivering estimated yearly sales of up to $1.08 billion. To achieve this with their target fleet size of 2 VMSs and 5 VSSs, Virgin Galactic would have to increase the VSS flight capacity to be 80 per year.

For 2023, it is assumed Virgin Galactic will be operating 1 VMS and 2 VSSs, which will give them a yearly capacity of 100 flights.

Blue Origin has not stated a goal for annual launches. However the turnaround time between the first manned suborbital flight and the second was 37 days, 48 days between the second and third launches, and 59 days between the third and fourth launches. Assuming a minimum of 37 days, this would allow up to 9 launches a year per vehicle. This would give Blue Origin an annual capacity of 54 customers delivering estimated yearly sales of up to $10.8 million and as high as $1.512 billion for each launch vehicle dedicated to space tourism flights. Blue Origin has not released any information on their spaceflight system lifecycle.

For 2023, it is assumed that Blue Origin will have 2 vehicles in operation.

Estimated market supply by 2023

The following table summarizes the estimated annual market supply for space tourism by 2023.

Market dynamics

The space tourism market will be subject to a variety of changes over the next 5 to 10 years. Market dynamics that are expected to transform the space tourism market include:

- government policy, regulations, and oversight,

- service provider safety records,

- changing customer demographic and customer motivations,

- number of competitors and nature of competition, and

- competition from product substitutions.

Government policy, regulation, and oversight

Government policy, regulation, and oversight can easily make a space tourism business unsustainable overnight. For space tourism businesses based in the United States, government regulation and oversight have been kept intentionally light in order to allow the space tourism industry to develop. However, following a learning period scheduled to end in 2023, the government is expected to implement more formal industry regulation and oversight. These changes could include mandating safety features related to passengers which may require significant changes and certification of the space vehicle, launch and recovery systems.

Currently, SpaceX is uniquely positioned because their spaceflight system is already certified safe for human spaceflight by NASA, and has a growing history of flight safety.

Virgin Galactic is the most exposed of the space tourism businesses because of their lack of a passenger escape system. Moreover, Virgin Galactic has a track record of safety issues which are well documented in the 2021 equity report entitled “Putting the Zero in Zero-G“. Of particular note, in September 2014 during a test flight the spacecraft broke up, killing the co-pilot and seriously injuring the pilot.

Service providers safety records

The space tourism market faces the existential threat of an accident – any accident, by any space tourism business – that involves death or injury to customers or individuals on the ground. Such an accident would have a chilling impact on customer demand and would result in lengthy accident inquiries culminating in the implementation of new government safety regulations and oversight.

Changing customer demographic and motivations

The nature of the customer demographic will change, for example –

The Space Tourism Market Study and other studies show that the space tourism market is very price elastic and as ticket prices decline, the number of prospective customers will increase. When ticket prices decline to approximately $100,000 per passenger, the space tourism market demographic will expand to include high net worth individuals, which represents an additional 18.5 million individuals.

Currently space tourism experiences are primarily English-centric and Russian-centric. Customers will soon expect space tourism experiences in different languages, for example Japanese, German, and Mandarin.

The nature of customer motivations will undergo changes. For example, one of the top three motivations to be a space tourist is the desire to be a pioneer, i.e. one of the first. At some point in the future space tourism will cease to be perceived as a pioneering activity and that may have an effect on customer demand.

Customer motivations will certainly be influenced by service provider marketing, trusted opinion leaders, and public sentiment (e.g. environmental impact). Service providers can be expected to focus on amplifying motivations that align with their product experience and their targeted customer type (e.g. Innovators, Early Adopters, Early Majority, Late Majority, Laggards).

Number of competitors and nature of competition

Today suborbital and orbital space tourism are dominated by vertically integrated organizations such as Blue Origin, Virgin Galactic, Roscosmos, and SpaceX; each is responsible for designing and manufacturing all their core technology including space capsules, launch boosters, spacesuits, and launch facilities.

The number of competitors and nature of competition are expected to change over time –

New vertically integrated competition

Additional vertically integrated competition is expected to emerge from the United States (e.g. Boeing, Sierra Space) , China, and Europe (Ariane).

Complementary and competitive

There is also a new breed of vertically integrated companies such as Axiom Space who are focused on building and operating orbital destinations for use by their customers. Axiom is responsible for private astronaut mission recruitment and management for their space tourism customers. They contract with other organizations to transport their customers to and from the ISS and their orbital facilities. They have announced that they will be using SpaceX for their first 4 launch missions. Axiom plans to launch up to 2 private astronaut missions per year to the ISS subject to aligning with flight opportunities made available by NASA.

Axiom Space is expected to be the major supplier of private astronaut missions to launch service providers.

By 2023 it is expected that Boeing will be providing launch services. Axiom Space has agreements in place with both SpaceX and Boeing.

Axiom Space will be complementary because they will provide a steady supply of private astronaut missions. They will be competitive because they will be the ones controlling which launch provider is offered the private astronaut missions.

Axiom has some interesting projects lined up that will further sustain demand for private astronaut missions:

- Axiom and the Discovery Channel are collaborating on a Reality TV show called “Who Wants To Be An Astronaut?“. The TV show will air on the Discovery Channel in 2022. The winner will fly on the second Axiom private astronaut mission Ax-2.

- Axiom was selected by Space Entertainment Enterprises to build an inflatable multipurpose entertainment and content studio in orbit. The studio will be integrated with the Axiom Segment of the ISS and is expected to be operational by the end of 2024.

A new type of competition

The pioneering, vertically integrated companies have made great progress in reducing the barriers to market entry caused by challenges associated with: technology; market development; and Government policy and regulatory environment. This progress is a double edged sword for the pioneers, since it also facilitates the emergence of new competition in the form of horizontally integrated competition.

A business ecosystem of horizontally integrated companies is already emerging. These companies specialize in building-block products and services such as propulsion systems, life-support systems, space suits, flight control systems, launch vehicles, training, launch facilities, mission planning and management, etc. Out of this ecosystem, companies will emerge which will focus on delivering space tourism products and services based on economies of scale and best-of-breed. An example being that of a private astronaut mission recruitment and management, business such as Space Adventures who focus on delivery of tailored space experiences to their customers. Space Adventures contracts for the launch services and training with other organizations such as NASA, NASTAR, Zero-G, SpaceX and Roscosmos. Another example is that of spaceports. Spaceports are commercial facilities for launching and receiving spacecraft. There are commercial spaceports popping up around the world. The US currently has 13 FAA licensed spaceports.

The coming tsunami of competition and innovation

The space tourism market is likely to experience a vertical to horizontal market transformation over the next 10 years. Such transformations have happened in the past in markets originally dominated by large vertically integrated companies, e.g. personal computers, telecommunications equipment. The emergence of the business ecosystem mentioned above, is the beginning of such a transformation. The transformation is expected to be fueled in part by venture capital investment in commercial space companies. The benefits to customers will be reduced costs and increased choices.

Product substitutions

Suborbital and orbital space tourism businesses will also face new competition in the form of product substitutions. Competition is expected to come from: high altitude balloons; high fidelity telepresence experiences; zero gravity parabolic airplane rides; ground based simulations; and media experiences (e.g. virtual reality, documentaries, reality TV).

Space Perspective is offering high-altitude balloon flights which will take their customers to an altitude of 30 km. Each flight carries one crew member and up to 8 passengers. Tickets are $125,000. There are no preflight training or health requirements. If you’re healthy enough to board an airplane you are good to go. Flights will start in 2024. They have over 500 tickets reserved with fully refundable deposits, giving them potential sales revenue of $62.5 million. They are fully booked for 2024 and are taking reservations for 2025 and beyond.

The increasingly affordable Virtual Reality (VR) headsets such as Oculus are bringing us closer to the tipping point where VR matures into a mass market which can sustain customized VR experience businesses.

There is an immersive space tourism experience that is currently available on Oculus called “SPACE EXPLORERS: The ISS Experience”. The “SPACE EXPLORERS” Oculus experience was created over a period of two years during which time the production company worked directly with ISS astronauts.

The article “SPACE TOURISM – Is this what the future looks like?” provides more insight into how the space tourism market may be disrupted by telepresence based on virtual reality headsets and robotics.

Discussion

Roscosmos launched the space tourism “experiment” when they flew the first space tourist into orbit in 2001. Between 2001 and 2009 they launched 8 multinational space tourists into orbit. They were the only game in town until 2021. Things changed in 2021 when SpaceX and Blue Origin started to launch space tourists on orbital and suborbital flights.

The year 2021 marked the beginning of space tourism commercialization. In 2021, SpaceX, Roscosmos and Blue Origin collectively launched 3.6X more passengers into space than the 19 preceding years between 2001 and 2020.

The estimated market growth between 2021 and 2022, is + 257% increase in private astronauts carried and + 98% increase in sales. This large jump is reflective of SpaceX and Blue Origin entering into the space tourism market, and Roscosmos restarting after pausing space tourism flights in 2010.

The million dollar question is what will customer demand look like beyond 2021? And will that demand be sustained or will it be short-lived?

Unless the orbital market segment customer demand increases significantly, it is unlikely that a launch service provider will be able to survive solely on orbital space tourism customers. Orbital space tourism will be relegated to a side business for launch service providers who have human rated space vehicles. Case in point, Roscosmos has stated that they support space tourism as a means to help subsidize their space research activities and as a matter of national pride. Per each spaceflight, one space tourist covers the cost of building the Soyuz spacecraft, a second space tourist on the same flight delivers a profit.

Both space tourism market segments are faced with adoption challenges that will throttle demand.

Some adoption challenges such as risk will be addressed over time. The perception, and reality, of spaceflight risk will diminish as space tourism businesses establish a track record of safety. The rollout of government oversight will go far in addressing perceived, and actual, customer risk; for instance the establishment of such things as safety regulations, certification of vehicles for human spaceflight, and licensing of space tourism businesses.

Other adoption challenges will remain problematic, such as ticket price. Until the economies associated with launching an individual into space change, the ticket prices will remain high. The ticket prices for orbital and suborbital flights will ensure that space tourism will remain the playground of the very wealthy for years to come.

There is significant current market demand for both suborbital and orbital market segments. Suborbital space tourism growth will be capacity constrained in 2022 and 2023; orbital space tourism will have a surplus of capacity in 2023.

It is likely that orbital space tourism customer demand will be defined by the limited availability of private astronaut mission slots to the US and Russian segments of the ISS; customers may defer purchases until they can travel to an orbital destination rather than remain in a claustrophobic space capsule orbiting the earth.

Market dynamics have the potential to disrupt orbital and suborbital space tourism and transform the market into something entirely different.

It is too early to determine if the space tourism market will transition to Early Majority customers or if it end up as a boutique market for Early Adopters.

Interesting times!